(English) COMPLETE WEBINAR SERIES - Managing the Accounting for Assets, Liabilities, Revenue and Expenses by Tan Kok Tee

Everything you need to know about Managing the Accounting for Assets, Liabilities, Revenue and Expenses

Payment include

- Lesson 1 : Managing the Accounting for Assets, Liabilities, Revenue and Expenses

- (Sat) 06 March 2021, Saturday, 9:00 am – 1:00 pm

- Lesson 2 : Managing the Accounting for Assets, Liabilities, Revenue and Expenses

- (Sat) 13March 2021, Saturday, 9:00 am – 1:00 pm

- Lesson 3 :Managing the Accounting for Assets, Liabilities, Revenue and Expenses

- (Sat) 20 March 2021, Saturday, 9:00 am – 1:00 pm

- Lesson 4 : Managing the Accounting for Assets, Liabilities, Revenue and Expenses

- (Sat) 27 March 2021, Saturday, 9:00 am – 1:00 pm

If you wish to get FULL WEBINAR SERIES (Lesson 1-4) ,

Payment inclusive of Replay, Certificate of Completion to manually claim your CPD/CPE points. Download of PDF Notes. Only PDF training materials are downloadable. MP4 Video Replays are non-downloadable (unlimited streaming is available for mp4 replays).

No Jam. No Parking.Bee Happy. Learn Online.

Introduction

It is a requirement for all assets, revenue and liabilities are accounted for appropriately in accordance with Accounting Standards set by the Authorities and Policies set by the organization within the framework of the Accounting Standards.

Recognition and measurement of assets, revenue and liabilities give rise simultaneously to the recognition of other elements affecting the Profit and Loss, Cash Flow and the Shareholders equity situation in an organization.

For example, the requirement to recognize future decommissioning cost as an asset would simultaneously create a liability at initial stage of recognition and that such liability can be subject to change in value at a later date affecting the organization’s financial management.

This training will thus help all Accounting personnel to get equip with a comprehensive knowledge in accounting for the Assets and Liabilities to provide appropriate Financial Information to management to make a more effective decision especially during this COVID 19 pandemic time.

Learning Objectives

- Enrich the fundamental knowledge and concept of Accounting for Assets and Liabilities in practice.

- Identify the requirements to comply requirements set in the Accounting Standards and Policies of treating each and every such transaction.

- Master the understanding of substance over form kind of asset recognition in Leases.

- Systematically identify the areas of concern in the Assets and Liabilities Accounting for highlighting to Management for prompt corrective action.

- Take timely corrective actions in overcoming financial weakness.

Target Participants

- Accounts and Administrative Assistants,

- Junior Accounts Executives & Accounts Supervisors,

- Fresh Accountants / Accounting Graduates,

- Finance Managers / Assistant Finance Managers

- All other persons who are involved in and/or interested to reskill or enhance their practical accounting skills to support their business operations.

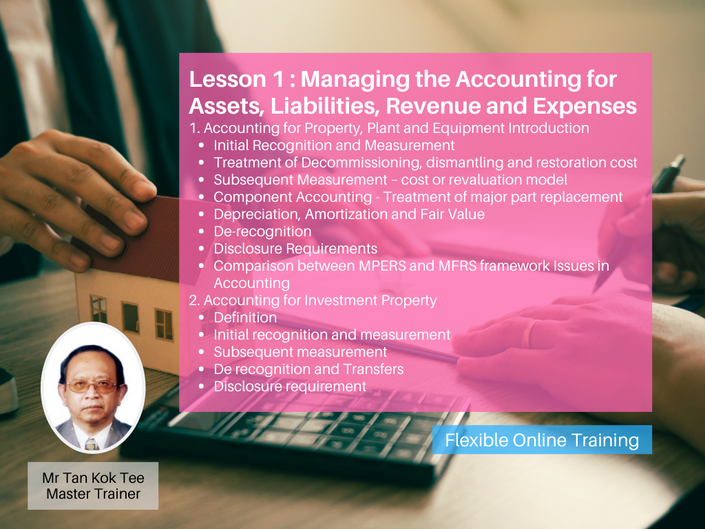

Lesson 1

1. Accounting for Property, Plant and Equipment

- Introduction

- Initial Recognition and Measurement

- Treatment of Decommissioning, dismantling and restoration cost.

- Subsequent Measurement – cost or revaluation model

- Component Accounting - Treatment of major part replacement

- Depreciation, Amortization and Fair Value

- De-recognition

- Disclosure Requirements

- Comparison between MPERS and MFRS framework.

- Issues in Accounting

2. Accounting for Investment Property

- Definition

- Initial recognition and measurement

- Subsequent measurement

- De recognition and Transfers

- Disclosure requirement

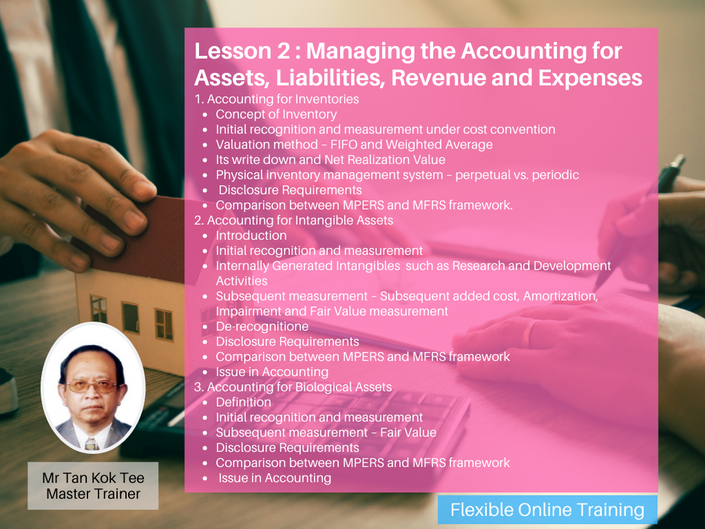

Lesson 2

1. Accounting for Inventories

- Concept of Inventory

- Initial recognition and measurement under cost convention

- Valuation method – FIFO and Weighted Average

- Its write down and Net Realization Value

- Physical inventory management system – perpetual vs. periodic

- Disclosure Requirements

- Comparison between MPERS and MFRS framework.

2. Accounting for Intangible Assets

- Introduction

- Initial recognition and measurement

- Internally Generated Intangibles such as Research and Development Activities.

- Subsequent measurement – Subsequent added cost, Amortization, Impairment and Fair Value measurement

- De-recognition

- Disclosure Requirements

- Comparison between MPERS and MFRS framework.

- Issue in Accounting

3. Accounting for Biological Assets

- Definition

- Initial recognition and measurement

- Subsequent measurement – Fair Value

- Disclosure Requirements

- Comparison between MPERS and MFRS framework.

- Issue in Accounting

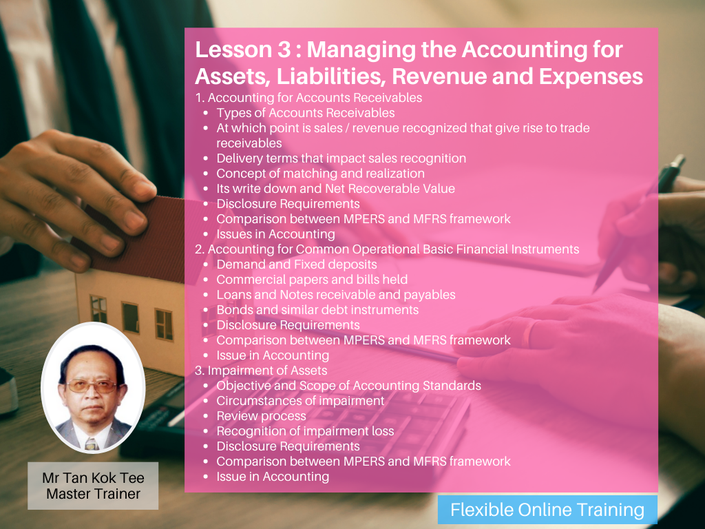

Lesson 3

1. Accounting for Accounts Receivables

- Types of Accounts Receivables

- At which point is sales / revenue recognized that give rise to trade receivables

- Delivery terms that impact sales recognition

- Concept of matching and realization

- Its write down and Net Recoverable Value

- Disclosure Requirements

- Comparison between MPERS and MFRS framework.

- Issues in Accounting

2. Accounting for Common Operational Basic Financial Instruments

- Demand and Fixed deposits

- Commercial papers and bills held

- Loans and Notes receivable and payables

- Bonds and similar debt instruments

- Disclosure Requirements

- Comparison between MPERS and MFRS framework.

- Issue in Accounting

3. Impairment of Assets

- Objective and Scope of Accounting Standards

- Circumstances of impairment

- Review process

- Recognition of impairment loss

- Disclosure Requirements

- Comparison between MPERS and MFRS framework.

- Issue in Accounting

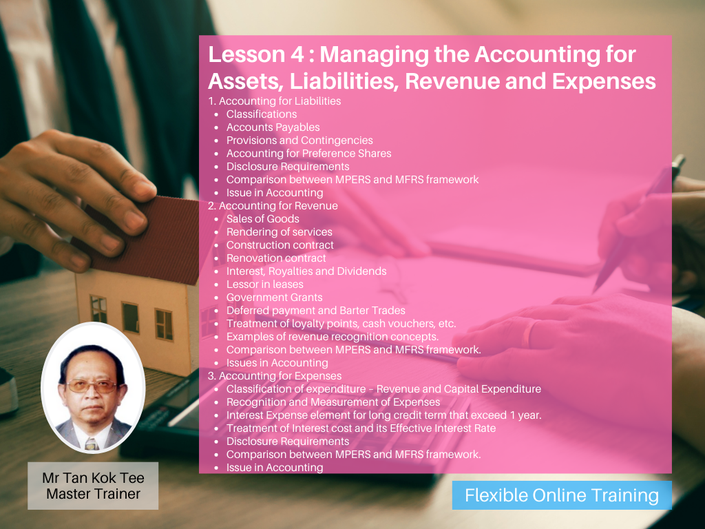

Lesson 4

1. Accounting for Liabilities

- Classifications

- Accounts Payables

- Provisions and Contingencies

- Accounting for Preference Shares

- Disclosure Requirements

- Comparison between MPERS and MFRS framework.

- Issue in Accounting

2. Accounting for Revenue

- Sales of Goods

- Rendering of services

- Construction contract

- Renovation contract

- Interest, Royalties and Dividends

- Lessor in leases

- Government Grants

- Deferred payment and Barter Trades

- Treatment of loyalty points, cash vouchers, etc.

- Examples of revenue recognition concepts.

- Comparison between MPERS and MFRS framework.

- Issues in Accounting

3. Accounting for Expenses

- Classification of expenditure – Revenue and Capital Expenditure

- Recognition and Measurement of Expenses

- Interest Expense element for long credit term that exceed 1 year.

- Treatment of Interest cost and its Effective Interest Rate

- Disclosure Requirements

- Comparison between MPERS and MFRS framework.

- Issue in Accounting

Your Instructor

Tan Kok Tee has 40 years of working experience in accounts &financial, strategic and general management field. He has held a variety of leadership and senior management roles in various organizations, starting in the Accounts & Finance Department until CFO level and the last being Group Chief Executive Officer. More than half of these times are spent in the Manufacturing, Marketing & Distribution and Services organizations, including those with the then Inchcape Timuran Berhad, Metroplex Berhad, Perdana Industries Berhad.

He is a Fellow member of the Association of International Accountants, UK; Member of the Institute of Public Accountants, Aust.; Certified Commercial Accountant, (M); Member of the Chartered Tax Institute of Malaysia; Member of the Malaysia Associations of Company Secretaries (M) and a Gold Mastery Holder in Reinventing Strategic Planning and Management from the Haines Centre for Strategic Management, sponsored by University of San Diego, USA.

He is also a Certified Trainer with PMSB’s (HRDF) Train The Trainer Certificate since 2009, a GST Agent registered with MOF & Holder of the GST MyGCAP certificate from RMCD and a Life Member of the Malaysian Institute of Directors.

Kok Tee has been involved in Advisory, Training and Facilitation on a part-time basis from 2009-2013, and full time from 2014 to now. To-date he had conducted about 400 training workshops throughout Malaysia on topics on GST; SST; Practical Accounting for Accounting Staffs; Reading, Analyzing and Interpreting Financial Statement; Accounting and Finance for Non-Accounting Managers; Customers Credit Evaluations and Collection Strategies; Incoterms, LC Operations and Trade Financing; Reinventing the Strategic Planning and Management and Financial Statement Hands On Application to MBRS, for both in-house as well as public, including to Government Authorities, Chamber of Commerce, Government Link Companies, Banks, Malaysian Institute of Accountants, Chartered Institute of Management Accountants, CPA Australia, Malaysian Institute of Chartered Secretaries and Administrators, Selangor State Human Resource Development Centre (SHRDC), Negeri Sembilan State Skills Development Centre (NSSDC), Penang Skill Development Centre (PSDC), NGOs and many others public training providers.

Through them, Kok Tee have also conducted training for Shin Yang Group in Miri,Bintulu Port, Deleum Bhd., Boustead Plantation Bhd., Takahata, FBK Manufacturing, Brothers Industries, Integrated Logistics, Mega Logistics, Chung Hwa Picture Tubes, Ohara Melaka, Safran Aerospace, NEC Corp. of Malaysia, Kobe Precissions,Tecktronic& Sons Holdings, Julie Biscuit, Ornapaper Melaka, Sunway University, Audit and Tax Firms and many many more. To-date more than 15,000 executives has been trained by him and was a Lead GST Trainer for Malaysia Export Academy in 2014-2015.

Kok Tee has also been a hands on SST practitioner during the SST01 regime until its abolition. He also developed and delivered an entrepreneurship program specially designed for MBA students from GC University, Pakistan in collaboration with Sunway Education Group for period of 5 years (2010 to 2014) and was an invited speaker for the Asian Financial Controller’s Congress in 2009, 2010 and 2011.

Courses Included with Purchase

Original Price: RM236

Frequently Asked Questions

Sign Up Now ... See you "inside" the paid area soon !

We highly encourage you to pay via credit card for instant access to the content.

However, you have the option to pay via online bank in method, Click Here for Instruction to Pay Through Bank

Hi, My name is EvannaMiss8. I am a One Leg Kick , Happy go Lucky Organiser & Producer of Webinars & Online Training for Professionals, Directors & Management

If you are still blur blur about this webinar, no worries ya ... you may contact me directly using any of the below methods

Email: [email protected]

Whatsapp: +6012 203 8046

Facebook: https://www.facebook.com/learnabeeOfficial/

Bee Happy, Learn Online ...

Important Note: If you want to download the Certificate of Completion at the end of this course, please make sure the FULL NAME you key in is 100% Accurate ya ...